Garmin’s post-tariff strategy could include pricier watches and cutbacks

Garmin held its Q1 2025 earnings call this week, and like most other tech brands, it had to address the looming specter of tariffs while boasting about its record-setting profits. And its future plans are illuminating, both for Garmin fans and tech nerds in general.

Garmin earned $1.54 billion last quarter, an 11% boost driven mainly by its “Outdoor” and “Auto” segments, with a “record” $330 million operating income. And yet its stocks dipped by about 10% due to this earnings report.

Investors seem spooked by Garmin’s tariff outlook, even as the CEO, Cliff Pemble, assured that Garmin isn’t worried and has a plan to offset them.

I’ll break down Garmin’s anti-tariff strategy and how it may affect future Garmin watches, but my main takeaway from a week of earnings calls — including Garmin, Meta, Samsung, and others — is that the impact of appeasing shareholders will go beyond higher prices.

How Garmin will counterbalance tariffs

“Higher tariffs and more complex trade structures will be a normal part of business going forward,” Pemble warned at the start of the earnings call.

A quarter of Garmin’s U.S. revenue comes from products assembled in Taiwan, with a 10% baseline tariff once the temporary exemption expires. While they don’t use a “significant amount of material” from China, reciprocal tariffs will “weaken the U.S. dollar,” which makes up 60% of their profits.

Garmin’s CFO says that of the “estimated $100 million of increased costs from tariffs” in 2025, they will be “mostly offset by expected favorable foreign currency impacts and planned mitigations.” To the first point, Garmin believes that non-U.S. dollar currencies will strengthen, so its 40% of EMEA and Asia business will have inflated value.

However, it’s much less specific about its “mitigation” plans. Pemble says that Garmin is “pursuing mitigations, some of which have already been established, while others will take more time. We are not ruling anything out, and we intend to be strategic and selective with these actions.”

Pemble refused to say what these mitigations are (or will be), but it’s not hard to surmise.

Garmin’s ‘mitigations’ are hiding in plain sight

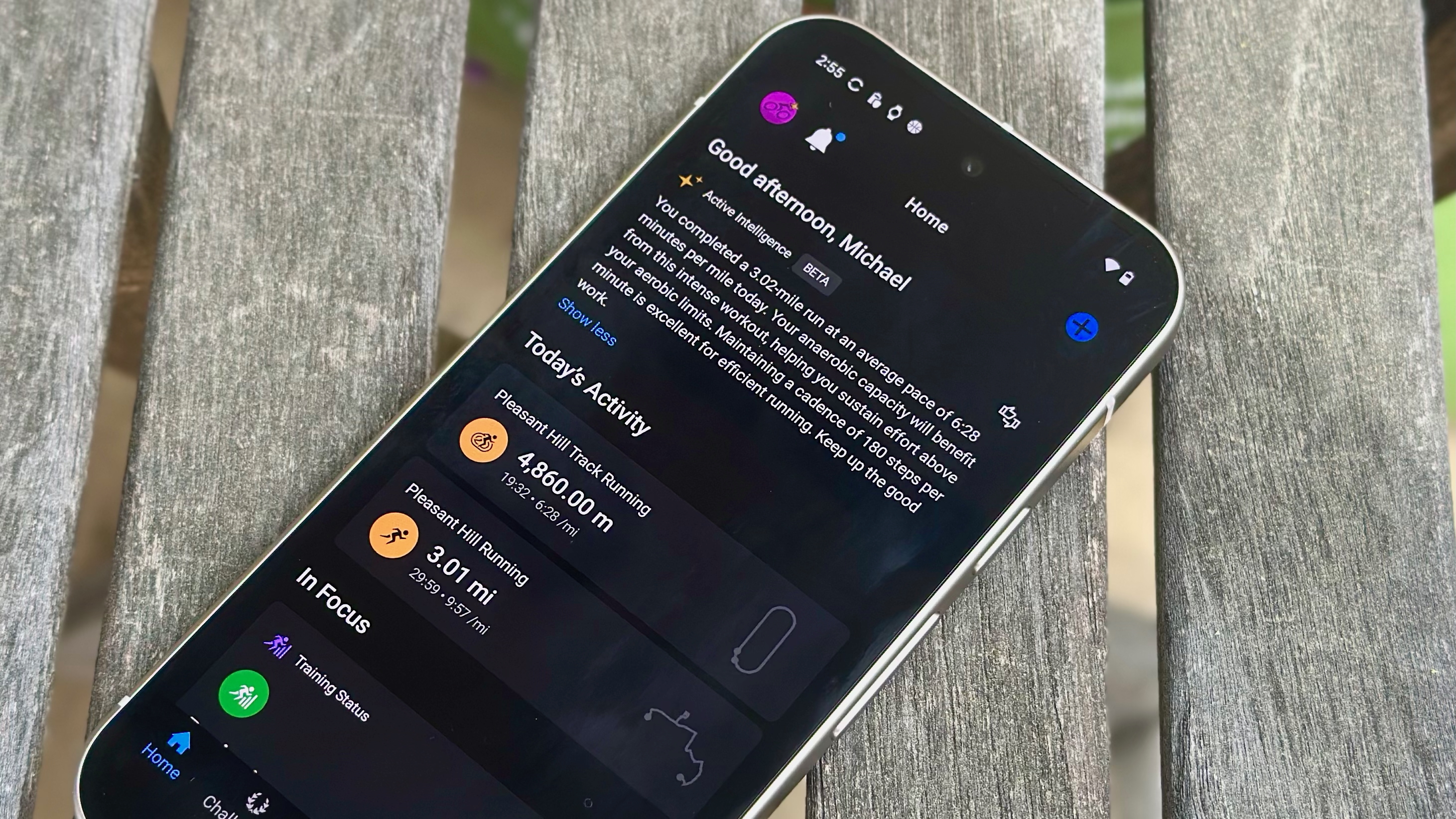

Garmin Connect Plus, for all its negative press and customer outrage, is an example of successful “mitigation” that’s already begun. A subscription gives Garmin a new revenue source, making post-launch updates more profitable as they increasingly fall behind a paywall.

During the earnings call, Pemble said that the AI boom made it the “right time” to launch Connect Plus, that “the response has been positive,” and that “this is a long-term thing for us, a very important part of our Fitness segment going forward.”

I’m not so sure about the positive response, but Garmin customers would probably prefer this optional nickel-and-dime solution to squeeze out more money over higher watch prices.

I doubt it’s a coincidence that Garmin upped its Fitness “revenue growth estimate” from 10% to 15% after just one quarter, so quickly after the Connect Plus launch and with no new major products besides the Vivoactive 6, which made few upgrades over its predecessor.

The Outdoor category had Garmin’s biggest YoY revenue boost with $72.3 million. The Garmin Fenix 8‘s continued popularity is the main reason, but the new Instinct 3 was another factor; it added an AMOLED display and better battery life but otherwise kept to the status quo with older sensors and few feature changes for a high price.

Garmin’s 2025 strategy with the Instinct 3 and Vivoactive 6 shows Garmin’s more subtle, in-progress strategy: sticking to a consistent release schedule while offering fewer improvements per generation, so it can tempt customers to upgrade more often without worrying about significant innovation.

The fact that Garmin hasn’t given its latest watches the Elevate v5 sensor feels like proof of this system. Garmin counts on its brand strength and popular training tools to tempt people enough that they ignore Garmin’s flaws, mitigating the need to offer a more competitive product.

Some Garmin watches may get more expensive

“Everything is on the table,” Pemble said when asked about increased Garmin watch pricing to mitigate tariffs. But that doesn’t mean every Garmin watch will be more expensive.

“We’re evaluating pricing not broadly, but specifically in context of each market and product line,” Pemble explained. “There are cases where definitely, there’s room to have different pricing, and there’s other cases [where] it’s more competitive and difficult to increase prices. So we’re managing it case by case.”

The Vivoactive 6, for instance, stayed affordable at $299, while the Fenix 8 was $200 more expensive. My guess is that Garmin will upcharge its premium-tier models because it already knows customers will pay above market rate, while the mainstream Venus and Forerunners stay low to compete with other fitness watch brands.

It’s also tried selling more budget “E” models like the Fenix E and Instinct E that cut major features, like an Apple Watch SE or Galaxy Watch FE. Selling more products, from premium to budget, is another way Big Tech brands are trying to combat tariffs.

Look to Big Tech for Garmin’s future strategy

Just this week, Meta warned shareholders that tariffs could dip Asia-based ad sales up to billions of dollars, while Samsung’s Q1 earnings explained how tariffs caused a “slowdown in growth” and will trigger declining smartphone demand.

Like Garmin, these Big Tech brands tried to assuage shareholders with their plans to counterbalance tariff effects. Samsung will “sustain profitability” with the upcoming Galaxy S25 Edge, while Meta will rely on Meta AI and Ray-Ban glasses to “offset” losses.

Basically, these companies plan to become more “efficient” and reprioritize their product categories to new, untapped areas. And the bigger the brand, the more tariff damage they’ll have to mitigate.

*APPLE ESTIMATES $900 MILLION IN COST INCREASES ON TARIFFS IN Q3May 1, 2025

Garmin could easily focus on that second strategy. It already started this trend with Connect+; the next step is more LTE watches, based on a recent Fenix 8 LTE leak.

Some Garmin fans have begged for a Whoop-style band for years, and while Garmin is unenthusiastic about smart rings, that could always change. Heck, Garmin could even revive its defunct Varia Vision lineup as fitness AR glasses, another growing trend.

The point is, Garmin sells a hundred different products a year; what’s a few more? It may decide to step outside its comfort zone and rush out new product categories it would have ignored in a pre-tariff world, simply to find new sources of revenue.