US stocks and dollar tumble as Trump fails to soothe economic fears

[ad_1]

US stocks and the dollar fell sharply on Thursday, giving back some of their huge gains in the previous session, as traders continued to fixate on Donald Trump’s tariffs and their potential hit to global growth.

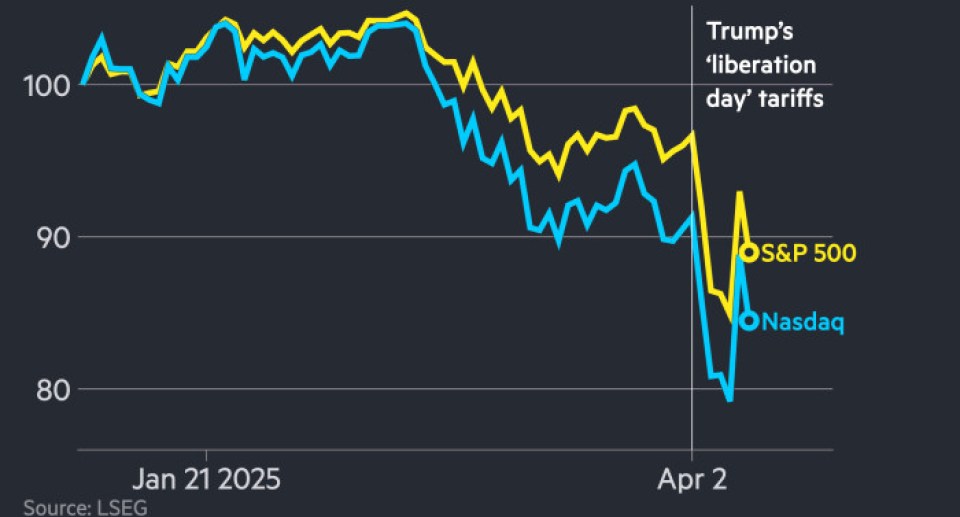

Wall Street’s blue-chip S&P 500 index, which on Wednesday soared 9.5 per cent in its best session since 2008, was down 3.9 per cent in late afternoon trading. It has fallen almost 7 per cent this month.

The tech-heavy Nasdaq Composite — which on Wednesday surged more than 12 per cent for its best day since 2001 — was down 4.7 per cent on Thursday. In currency markets, an index tracking the dollar against half a dozen peers tumbled 1.6 per cent.

Trump on Wednesday paused his steep “reciprocal” tariffs on trading partners, but kept in place a 10 per cent universal levy and announced plans to hoist duties on most Chinese goods to 125 per cent. A White House official clarified on Thursday that those levies would be on top of the previous 20 per cent rate already applied to Beijing.

Markets initially soared on Trump’s U-turn, but Wall Street banks and investors warned that even with the adjustments, America’s tariff rate would remain at the highest level in more than a century — something that would snarl growth or even tip the US economy into recession.

“Combined with the ongoing policy chaos on trade and domestic fiscal matters, along with the still-large losses in equity markets and hit to confidence, it remains difficult to see the US avoiding recession,” JPMorgan said.

Uncertainty over Trump’s trade policies and objectives is likely to “beset markets and macroeconomic outlooks in the months and quarters ahead”, added Bill Campbell, global bond portfolio manager at DoubleLine.

European stocks retreated from early gains, with the Stoxx Europe 600 index closed up 3.7 per cent. The UK’s FTSE 100 gained 3 per cent after rising 6.3 per cent earlier.

The yield on 10-year US Treasuries rose 0.05 percentage points to 4.4 per cent, signalling selling in US government bonds.

[ad_2]

Source link